For any enterprise, business unit, cost centre, department or even a project, an essential leadership skill is managing through Key Performance Indicators (KPIs).

Now it is important to stress this does not mean you can successfully manage a business without getting your hands dirty or ever leaving your office – it just can’t be done! Managing through KPIs only works if you combine it with “managing by walking around” (MBWA).

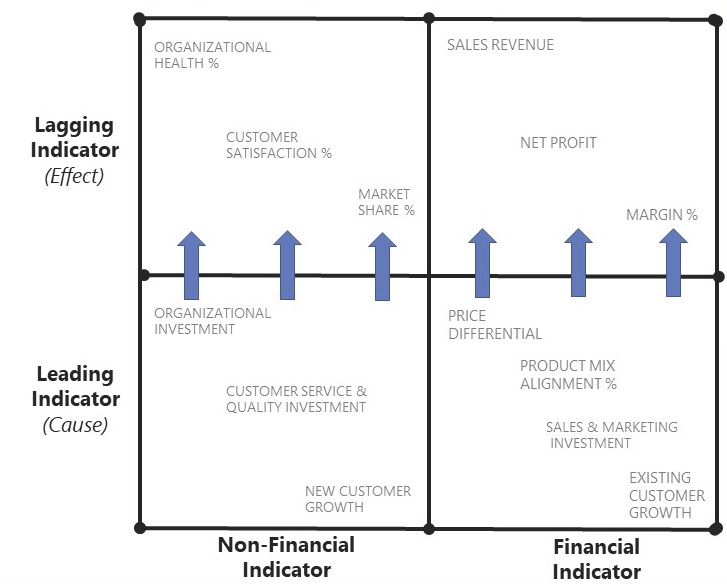

So before we get started, here are some important definitions (please refer to the diagram)

- Financial Indicators are monetary and typically appear on Profit & Loss Reports.

- Non-Financial Indicators measure key non-monetary outcomes and can cover many different aspects including customers, partners, markets and market positions, internal processes, quality, certifications, organisational health and people development.

- Lagging Indicators are the measures (financial and non-financial) by which your success or failure will ultimately be judged.

- Leading Indicators provide early warnings whether lagging indicators will be achieved on not.

So how do you develop a good (i.e well-balanced and comprehensive) KPI model for your unit?

There are 4 main steps with an implied sequence:

STEP 1. Identify your Financial Lagging Indicators

These will come from your financial objectives and targets.

Make sure you focus on the key ones – there should not be more than a handlful!

STEP 2. Identify your non-Financial Lagging Indicators

These will come from your non-financial objectives and targets

Again make sure you focus on the key ones and don’t miss any out.

STEP 3. Identify your Financial Leading Indicators

For each Financial Lagging Indicator ask what causes this to happen and how can this cause be measured. Remember you may have more that one cause for any single effect and likewise a single cause can have more than one effect. If you wish you can precisely model the dependencies between your leading and lagging indicators. For example, Sales & Marketing investment and Price Differential drive Sales Revenue. However, you need be careful you don’t over-complicate things with lots of crossed lines and miss the whole point. In my experience, you can easily keep it simple by doing it intuitively as in “these 3 leading indicators collectively act as good early warnings for these 3 lagging indicators.”

STEP 4. Identify your non-Financial Leading Indicators

Just follow the same steps as per your Financial Lagging Indicators. As with these you may sometimes need to be creative in identifing an appropriate leading indicator. Sometimes it will not be perfect (we call this a "proxy" indicator) but its better than nothing!

Summary

If you follow these steps to create a balanced KPI Model and have a process of regular review then you are well on the way to managing your business unit rather than it managing you! Don’t forget however, to combine this with MBWA. Finally using a realistic business acumen simulation, like XSIM or YSIM, is one of the best ways for managers and leaders to develop, practice and fine-tune their skills in "Managing through KPIs" in a safe and forgiving environment.

Further Reading

Causation or Correlation? Knowing the difference will make you a better leader!